The story of Carvana Stock Price is one of the most fascinating journeys in the modern stock market. As one of the most disruptive companies in the automotive industry, Carvana Stock Price has transformed the way people think about buying cars. Its rise, fall, and recovery phases have captured the attention of retail investors, Wall Street analysts, and everyday car buyers alike. Understanding Carvana’s stock price is not just about looking at charts and numbers—it is about examining the forces that drive consumer behavior, the resilience of innovative business models, and the challenges that come with scaling a groundbreaking idea.

In this comprehensive article, we will explore the history of Carvana Stock Price, the reasons behind its fluctuations, the opportunities and risks ahead, and what investors should consider when analyzing its long-term potential.

The Origins of Carvana and Its Entry into the Stock Market

Carvana Stock Price was founded in 2012 with the vision of revolutionizing the used car buying process. The company introduced a model that allowed customers to browse, finance, and purchase vehicles entirely online. One of its most iconic innovations was the car vending machine concept, which quickly became a symbol of its bold approach to retail.

When Carvana Stock Price went public in 2017, investor enthusiasm was high. Many saw it as the “Amazon of cars”—a platform that could digitize one of the last major industries still dominated by physical dealerships. The initial trading period was marked by optimism, as the market recognized the potential of shifting car buying into the digital age.

The stock price started modestly but quickly gained momentum as revenue grew and customer adoption accelerated. Analysts who initially doubted the sustainability of the model began to see signs of long-term promise.

Rapid Growth and Early Optimism

Carvana Stock Price reflected its hypergrowth trajectory during its early years as a public company. Consumers embraced the idea of avoiding dealership haggling, and the convenience of having vehicles delivered directly to their door added to the appeal.

Revenue growth numbers were staggering, and investors rewarded the company with a soaring stock price. The narrative at the time was straightforward: Carvana Stock Price was not just selling cars, it was selling convenience, transparency, and trust—qualities often lacking in traditional dealerships.

By the late 2010s, Carvana Stock Price had established itself as a key player in the used car industry, competing with giants while still expanding into new markets. Its stock price became a reflection of high expectations and the belief that it could dominate online car sales.

The Pandemic Effect and an Explosive Rally

The onset of the global pandemic in 2020 created a unique environment for Carvana Stock Price . Traditional dealerships struggled with closures and restrictions, while consumer demand shifted online. Carvana was perfectly positioned to capture this shift.

As people sought safe, contactless ways to purchase vehicles, Carvana Stock Price platform became more relevant than ever. Demand surged, and so did the stock price. Investors saw this as validation of Carvana’s long-term model.

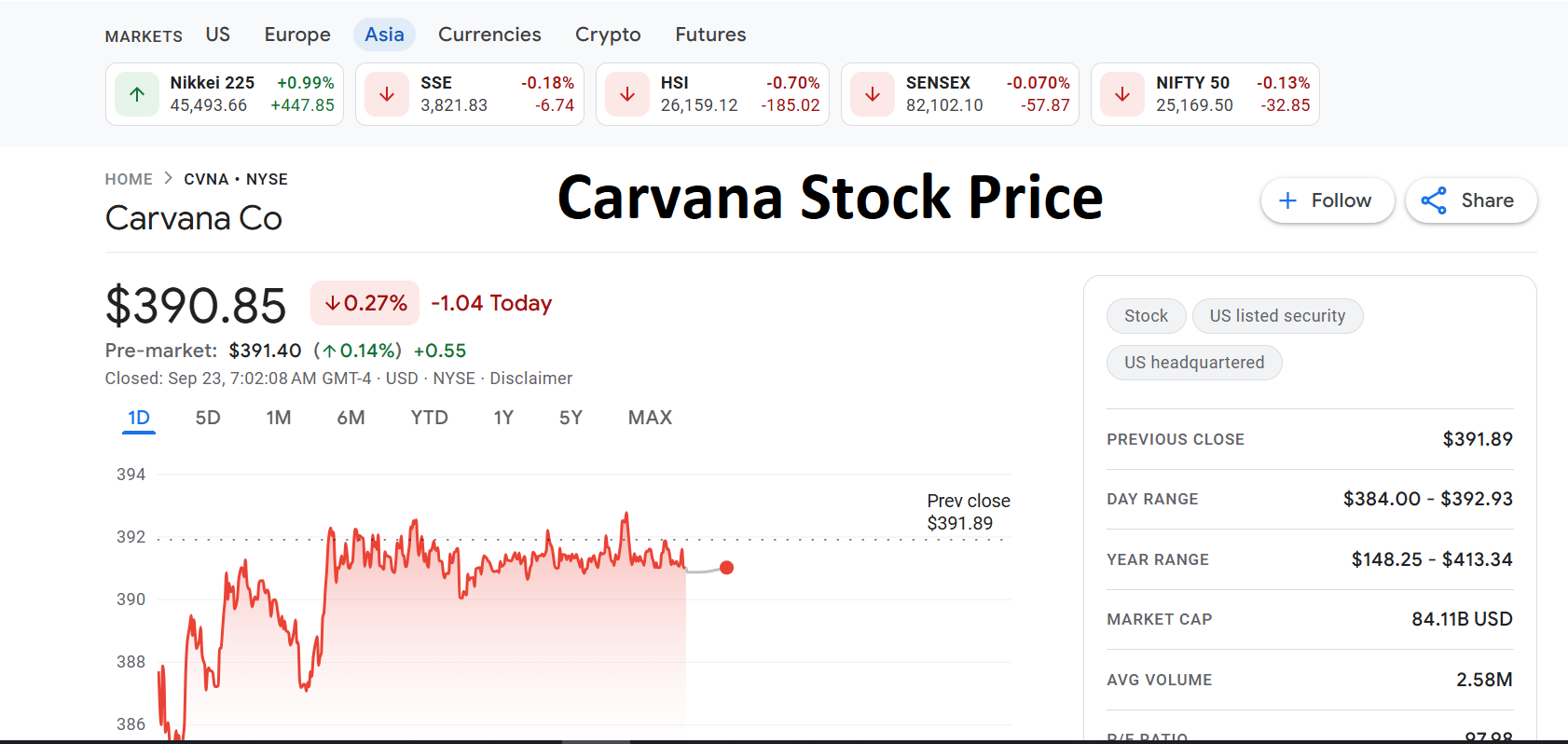

The rally during this period was extraordinary, with the stock price reaching all-time highs. Retail investors, inspired by the success stories of other disruptive companies, flocked to Carvana Stock Price . For a time, it seemed unstoppable, riding a wave of optimism and extraordinary growth.

Challenges Begin to Surface

However, as with many high-growth companies, challenges eventually emerged. While revenue continued to climb, profitability remained elusive. Operating costs increased as the company expanded aggressively. Logistics, vehicle reconditioning, and customer service all required significant investment.

Rising interest rates and inflation also had a direct impact on Carvana Stock Price business model. Financing became more expensive, and consumers began to pull back on big-ticket purchases like cars. At the same time, used car prices, which had spiked during the pandemic, began to normalize.

As these headwinds intensified, Carvana Stock Price started to decline. What had once been seen as unstoppable growth now looked like a company facing steep operational hurdles. Short sellers began targeting the stock, and investor sentiment shifted from enthusiasm to caution.

The Steep Decline and Investor Concerns

Carvana Stock Price eventually entered a prolonged period of decline, wiping out much of the gains from its peak. The fall was not just a reflection of macroeconomic conditions—it was also about investor doubts regarding the company’s ability to manage debt, achieve profitability, and sustain its business model in a more competitive environment.

Wall Street analysts who had once praised Carvana Stock Price began questioning its balance sheet strength. Headlines focused on concerns about bankruptcy risk and whether the company could restructure effectively. For investors who bought at the top, the crash was painful.

This dramatic swing highlighted the volatility of growth stocks and the dangers of assuming that past success guarantees future returns.

Signs of Stabilization and Recovery Efforts

Despite the difficulties, Carvana Stock Price has shown resilience. The company has worked on restructuring debt, streamlining operations, and improving efficiency. Its leadership has emphasized cost discipline while continuing to innovate in customer experience.

The market has started to recognize these efforts. While the stock price remains far below its highs, periods of recovery have signaled that investor confidence is not entirely lost. Some see this as an opportunity to invest in a beaten-down growth stock with significant upside potential if execution improves.

In many ways, Carvana Stock Price has entered a new phase: one that prioritizes survival, profitability, and strategic growth over rapid expansion at all costs.

Factors Driving Carvana’s Stock Price Today

To understand Carvana’s current stock price movements, one must first examine the demand side of its business. Consumer demand for used cars remains the most direct driver of revenue, with shifts in disposable income, financing costs, and overall confidence shaping buying behavior. At the same time, macroeconomic conditions such as interest rates, inflation, and broader economic stability exert a strong influence, determining both the affordability of vehicles and the willingness of buyers to make large purchases.

On the other side, competitive and operational factors also play a significant role. Carvana Stock Price faces growing pressure from traditional dealerships, rival online platforms, and new tech entrants seeking to capture market share. Investors are also focused on how efficiently the company manages its operations, controls costs, and works toward sustainable profitability. Debt management is particularly critical, as Carvana’s ability to restructure and service its obligations will continue to shape investor sentiment and market confidence in its long-term viability.

The Long-Term Outlook for Carvana Stock

The future of Carvana Stock Price remains a topic of intense debate, with contrasting perspectives shaping investor sentiment. Supporters believe the company still holds immense potential to disrupt the used car market, thanks to its strong brand recognition and innovative digital-first model. This optimism is fueled by the possibility that Carvana Stock Price could redefine how people buy cars, making the process more seamless and accessible. Critics, however, point to significant challenges such as rising debt obligations, fierce competition, and the cyclical nature of the auto industry, which could all weigh heavily on its ability to sustain growth.

Looking ahead, several scenarios may play out. A steady recovery could occur if Carvana Stock Price manages its debt effectively and reaches profitability, while continued volatility is likely as the market balances hope with caution. There is also the possibility of strategic partnerships or acquisitions that could shift the company’s trajectory. For long-term investors, the central question is whether Carvana’s bold vision of transforming the car-buying experience can evolve into a business model that consistently delivers sustainable profits.

What Investors Should Consider

Investors analyzing Carvana Stock Price need to adopt a balanced perspective that goes beyond simply looking at past performance or projecting future potential. A thorough evaluation starts with understanding the company’s financial foundation, particularly the strength of its balance sheet, while also keeping a close eye on industry trends such as the shift toward digital car retailing and fluctuations in used car pricing. Broader economic conditions, especially interest rates and their impact on consumer financing, play a critical role as well, influencing both demand and affordability.

Equally important is an assessment of how effectively Carvana Stock Price management can respond to evolving market conditions and operational challenges. The company still carries the label of a high-risk, high-reward investment, with its long-term trajectory uncertain. For investors, the key decision lies in whether they trust the company’s vision of reshaping the car-buying experience to ultimately translate into lasting profitability and growth.

Conclusion: The Evolving Story of Carvana’s Stock Price

Carvana Stock Price has traveled a path filled with excitement, volatility, and uncertainty. From its early days of promise to its explosive pandemic rally and subsequent challenges, the company has remained at the center of market conversations.

For some, Carvana Stock Price represents the future of car buying—an innovative platform redefining an outdated industry. For others, it is a cautionary tale of rapid growth followed by financial strain.

What cannot be denied is the influence Carvana Stock Price has had on reshaping consumer expectations in automotive retail. Its journey continues to offer valuable lessons about innovation, market cycles, and the unpredictable nature of disruptive companies.