When people talk about global banking giants, HSBC Holdings plc almost always enters the conversation. As one of the largest and most influential financial institutions in the world, HSBC’s share price attracts serious attention from investors, analysts, and even casual market watchers. Whether you’re a long-term investor looking for stability or a short-term trader seeking opportunities, understanding the dynamics behind the HSBC share price is essential.

In this article, we’ll explore the story behind HSBC’s stock performance, the key factors influencing its value, historical trends, dividends, and what the future might hold for shareholders.

A Brief Overview of HSBC and Its Global Presence

HSBC isn’t just another bank—it’s a financial empire with roots going back more than 150 years. Founded in 1865 in Hong Kong and Shanghai, HSBC was originally created to facilitate trade between Europe and Asia. Over the decades, it has grown into one of the world’s largest banking and financial services organizations, with a presence in more than 60 countries and territories.

The name “HSBC” stands for The Hongkong and Shanghai Banking Corporation, and that heritage still influences how the company operates today. The bank’s headquarters are now in London, but its Asian business remains one of its biggest strengths. It’s this East–West balance that gives HSBC its unique global footprint and makes its share price particularly interesting to track.

When investors buy HSBC shares, they aren’t just buying into a single regional bank—they’re investing in a global financial network that serves millions of customers, from individuals and small businesses to multinational corporations. That international reach means the HSBC share price is influenced by a wide range of economic and political factors, not just those in the UK.

In essence, HSBC’s global reach is both its greatest strength and one of its biggest challenges. While it allows the company to access growth markets around the world, it also exposes it to risks from different economies, currencies, and regulations. Understanding that balance is key to interpreting its share price movements.

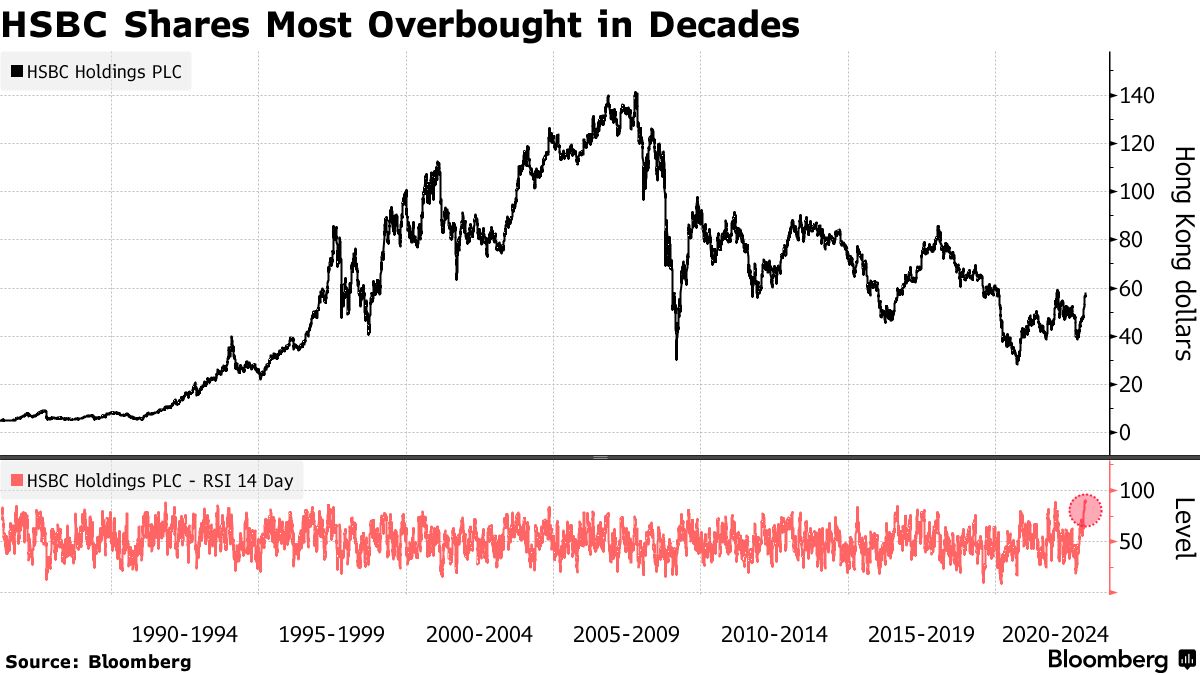

The Performance Journey of the HSBC Share Price

To understand where the HSBC share price is today, it helps to look back at where it has been. Over the last few decades, the stock has experienced multiple ups and downs, often reflecting broader global events.

In the early 2000s, HSBC’s share price was relatively stable, benefiting from its diversified operations and strong management. However, the 2008 global financial crisis was a turning point for nearly every major bank in the world. While many competitors suffered heavy losses or even collapsed, HSBC managed to weather the storm better than most due to its conservative risk management. Even so, its share price took a significant hit, as investor confidence in the entire banking sector plummeted.

After the crisis, HSBC’s recovery was steady but cautious. The 2010s were marked by strategic restructuring, as the bank sold off non-core assets and focused on strengthening its Asian and UK businesses. The share price reflected this transformation—there were periods of modest growth followed by pullbacks whenever global economic uncertainty surfaced.

More recently, the COVID-19 pandemic caused another round of turbulence. Like many financial stocks, HSBC shares fell sharply in early 2020 as fears of economic shutdowns and reduced global trade spread. But as markets recovered, the bank demonstrated resilience, supported by its diversified revenue streams and cost-cutting initiatives.

Today, the HSBC share price continues to fluctuate based on market sentiment, interest rate policies, and the overall performance of global economies. It’s a stock that rewards patience and a long-term outlook rather than short-term speculation.

Key Factors Influencing the HSBC Share Price

There’s no single factor that determines HSBC’s stock value. Instead, its share price is shaped by a complex mix of global forces, economic data, and company-specific developments.

One of the biggest drivers is interest rates. As a bank, HSBC’s profitability is heavily tied to net interest margins—the difference between what it earns on loans and what it pays on deposits. When central banks raise interest rates, banks generally benefit because they can charge more for loans. However, higher rates can also slow economic growth, which in turn may reduce borrowing and spending.

Another major influence is global economic health. Because HSBC operates across multiple continents, events like trade tensions, recessions, or geopolitical instability can all impact its share price. For example, concerns about China’s economy or regulatory crackdowns on foreign banks often lead to short-term declines in HSBC’s valuation.

Then there’s the foreign exchange effect. Since HSBC earns revenue in various currencies—pounds, dollars, euros, yuan, and more—fluctuations in exchange rates can affect reported earnings. A weaker British pound, for instance, can sometimes boost profits when overseas earnings are converted back to sterling.

Finally, investor sentiment plays a huge role. Positive news, such as strong quarterly results, dividend increases, or strategic investments, can drive the share price higher. Conversely, controversies, fines, or reports of regulatory investigations can trigger sell-offs.

In short, understanding the HSBC share price means keeping an eye not just on the company itself, but on the broader economic landscape in which it operates.

Dividends and Shareholder Value: A Big Attraction

One of the main reasons many investors hold HSBC shares is for its dividends. The bank has long been known for paying reliable, attractive dividends—something income-focused investors value highly.

Dividends represent the portion of profits that HSBC returns to shareholders. Historically, the bank has offered a solid dividend yield compared to many other UK-listed financial institutions. This steady income stream is especially appealing to retirees and long-term investors seeking consistent returns rather than speculative gains.

However, it’s worth noting that dividends haven’t always been smooth sailing. During the COVID-19 crisis in 2020, HSBC—like many banks—was instructed by the Bank of England to suspend dividend payments temporarily to preserve capital. That decision caused frustration among shareholders, but dividends have since been reinstated as profitability improved.

Today, HSBC’s dividend policy aims to strike a balance between rewarding investors and maintaining financial flexibility. The company’s management has expressed confidence in its ability to generate strong free cash flow, which supports ongoing dividend payments and potential share buybacks.

If you’re looking at the HSBC share price from an income-investment perspective, dividends are a critical piece of the puzzle. They not only enhance total returns but also signal the company’s financial strength and confidence in future earnings.

How Global Events Shape HSBC’s Market Value

Because HSBC operates across so many regions, its share price often reacts to global political and economic events more than local news. The bank’s fortunes are tied closely to international trade, cross-border finance, and emerging markets.

For instance, when relations between the US and China grow tense, HSBC often finds itself caught in the middle. The bank’s deep ties to both Western and Asian markets mean it must carefully balance its business operations. Investors sometimes worry that sanctions, trade wars, or diplomatic strains could affect its profitability.

Similarly, economic trends in China and Hong Kong can significantly influence the HSBC share price. A slowdown in the Chinese economy, changes in property markets, or regulatory interventions often lead to sharp movements in the stock.

Then there are macroeconomic factors like inflation, interest rate hikes, and energy prices—all of which can alter investor sentiment across the financial sector. HSBC’s ability to adapt and perform in these shifting conditions is part of what makes it a fascinating stock to follow.

In many ways, HSBC acts as a barometer for the global economy. When the world is thriving, HSBC tends to do well. When uncertainty rises, investors often become cautious, leading to downward pressure on the share price.

HSBC’s Digital Transformation and Future Growth Plans

In the modern financial landscape, digital innovation has become one of the most important areas of growth—and HSBC is no exception. The bank has been investing heavily in digital banking, fintech partnerships, and automation to streamline operations and improve customer experience.

From mobile banking to AI-powered fraud detection, HSBC is embracing technology to remain competitive in an increasingly digital-first world. This transformation not only helps reduce operational costs but also attracts younger, tech-savvy customers.

Another growth area is sustainability. HSBC has pledged to become a net-zero bank by 2050, aligning its operations and investments with global climate goals. The company is financing renewable energy projects, supporting sustainable businesses, and helping clients transition to greener models. These initiatives are not just good for the planet—they also appeal to ESG-conscious investors who factor environmental, social, and governance issues into their investment decisions.

As HSBC continues to modernize, analysts expect digital efficiency and green finance to play an increasingly important role in its future share price performance. The more the bank succeeds in innovating and adapting, the more likely it is to sustain long-term growth in both revenue and valuation.

Comparing HSBC Share Price to Other Major Banks

It’s often helpful to compare HSBC to other banking giants like Barclays, Lloyds, JPMorgan Chase, or Citigroup. Doing so provides perspective on how it performs within the broader financial industry.

Compared to its UK peers, HSBC stands out for its global exposure, particularly to Asia. This exposure can be both a blessing and a curse. While Asian markets offer higher growth potential than Europe or North America, they also come with more volatility.

HSBC’s share price often moves differently from purely UK-based banks. For instance, when China’s economy grows, HSBC might outperform its rivals. But when there’s instability in Asia, it can lag behind. On the other hand, compared to US-based giants like JPMorgan, HSBC tends to trade at lower valuation multiples—partly due to differing investor confidence levels and regulatory environments.

For investors seeking diversification, owning HSBC shares provides exposure to both developed and emerging markets in a single stock. It’s this unique blend of risk and opportunity that makes it stand out in the global banking sector.

The Future Outlook for HSBC Shares

So, what’s next for the HSBC share price? While no one can predict the market with absolute certainty, analysts generally remain cautiously optimistic. The bank’s strong capital position, focus on cost efficiency, and growing Asian footprint all suggest long-term stability.

Interest rates are expected to remain relatively high in the near term, which typically benefits banks by widening profit margins. At the same time, HSBC’s efforts to optimize its portfolio—such as exiting low-growth regions and focusing on core markets—could improve earnings quality.

However, challenges remain. Sluggish global economic growth, potential recessions, and regulatory scrutiny could all weigh on future performance. Moreover, competition from digital-only banks and fintech firms continues to rise, forcing traditional institutions like HSBC to innovate faster than ever.

Still, HSBC’s diversified model, strong balance sheet, and global presence provide a solid foundation for growth. For long-term investors willing to tolerate some volatility, the stock remains a compelling play in the international banking sector.

Should You Invest in HSBC Shares?

Whether or not HSBC is a good investment depends on your financial goals and risk appetite. If you’re looking for steady income through dividends and exposure to global markets, HSBC fits the bill nicely.

On the other hand, if you prefer high-growth, fast-moving tech stocks, you might find HSBC’s pace too conservative. Banking is a cyclical industry—profits rise and fall with interest rates and economic trends—so short-term fluctuations are to be expected.

That said, HSBC’s history of resilience, prudent management, and strategic adaptability make it an attractive long-term holding for many investors. Its strong dividend yield and consistent profitability are indicators of a well-managed institution that continues to evolve with the times.

Ultimately, investing in HSBC means believing in the strength of the global economy and the continued importance of international finance. For those who share that belief, the HSBC share price represents both stability and potential opportunity.

Conclusion

The HSBC share price tells a story far larger than just one company’s financial performance—it reflects global economic trends, cross-border trade, and the evolution of modern banking itself. From its roots in 19th-century Asia to its current role as a global financial powerhouse, HSBC has navigated crises, transformations, and market cycles with remarkable resilience.